Get a step ahead of the unexpected

Personal lines of insurance are your first lines of defense for shielding you and your family from the potentially devastating financial impact of unexpected events. From Homeowners and Auto Insurance to Life and Umbrella coverage, Alera Group’s licensed specialists can help you create a customized, cost-effective insurance program to safeguard both your possessions and your finances. More importantly, because we are an independent insurance brokerage, we compare policies from multiple carriers, so you get the best coverage at the best rate for your needs.

Protect the world you’ve built

You’ve invested a lot in building your life. Don’t leave it to chance. Alera Group helps you protect that world — and all the things in it — with policies tailored to your unique needs and situation.

Automobiles

Automobile insurance is crucial for protecting you from financial loss arising from accidents, theft and damage to your vehicles — including collector, classic and recreational types. It typically includes liability, collision and comprehensive coverage to safeguard your financial wellbeing.

Domestic Employee Workers' Compensation

This type of insurance covers workers in your home — such as health aides, nannies, housekeepers and gardeners — in the event of an accident or injury while on the job. It helps protect you from financial liability and ensures compliance with state labor laws.

Home

Homeowners Insurance is essential for protecting your structure and assets from damage caused by fire, theft, weather events and other perils. It typically includes coverage for the structure of your home, personal belongings and liability.

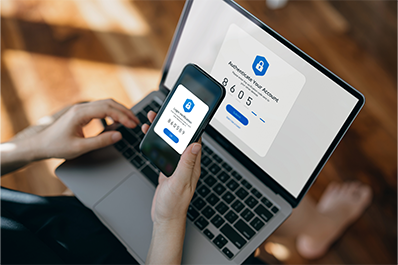

Identity Fraud

Identity fraud protection provides the support you need to recover from the nightmare of identity theft. It covers expenses related to restoring your identity, such as legal fees and credit monitoring.

Personal Cyber Security

Personal Cyber Security Insurance, also known as “Cyber Liability Insurance” and “Cyber Risk Insurance,” protects your digital life and assets from financial loss resulting from cybercrime — including cyberattack, cyberbullying and cyberextortion — as well as data breaches and online fraud.

Travel Accident

Travel worry-free knowing you're protected in case of injury or death. Travel accident coverage acts as Life Insurance regardless of, and in addition to, other insurance coverages.

Umbrella

An umbrella insurance policy goes beyond your standard Home and Auto Insurance to provide extra protection against large liability claims that could threaten your assets. With increased coverage comes increased peace of mind.

Fine Art and Jewelry

Protect your treasures with coverage for valuable property such as jewelry, fine art and collectibles. Your valuables will be covered from loss, theft and damage, allowing you to rest easy knowing your assets are protected.

Yachts and Boats

Protect your personal watercraft investment, such as a boat or yacht, with coverage aimed at potential damage to or loss of your recreational vessel. Your policy also protects you from legal liability due to the ownership or operation of the watercraft.

Recreational Vehicles (RVs)

Whether you use your recreational vehicle part-time or as a permanent residence, you want to protect your investment. RV coverage helps safeguard motorhomes, snowmobiles and other recreational vehicles against damage, theft and liability both on and off the road.

EXPERT EDUCATION

Events and Webinars

Property and Casualty

2024 P&C Symposium

Join us as we bring together top experts to cover key risk management topics, summarize economic and personal risk market conditions and hear recommendations for strategically engaging with carrier partners.

May 1, 2024 at 09:00 am CT |

Sign Up

THOUGHT LEADERSHIP

Insights

Property and Casualty

Navigating the Medical Malpractice Insurance Cycle

The rising trend of high-profile medical malpractice cases with significant monetary awards underscores the need for physicians and others in the medical industry to protect themselves with Medical Malpractice Liability Insurance.

April 23, 2024

Find out moreProperty and Casualty

Slower bookings, insurance challenges make for a tough year in hospitality

A combination of slowed bookings and a volatile insurance market is likely to make this a challenging year for the hospitality industry. After a two-year surge following the COVID-19 lockdowns — industry insiders refer to it as “revenge travel” — the sector anticipates more modest growth in demand throughout the remainder of 2024.

April 2, 2024

Find out moreProperty and Casualty

Environmental Liability Insurance: Stable market for a growing need

Despite stricter regulations and increased penalties for environmental contamination, market conditions remain stable for Environmental Liability Insurance — an outlier in a mostly hard market for property and casualty coverage. As Alera Group’s "2024 Property and Casualty Market Outlook" reports, now is an excellent time to secure this valuable coverage, especially if your organization owns property that is or may be contaminated.

March 20, 2024

Find out moreProperty and Casualty

The Role of Risk Management in Public Sector Insurance

Public sector organizations increasingly find themselves in an environment of shrinking budgets, staffing shortages, growing hostility and rising inflation.

May 31, 2022

Find out more